Institutions OTC Onboarding Process

The Institutions OTC Onboarding Process is a streamlined procedure designed to facilitate institutional clients in joining the CI.

-

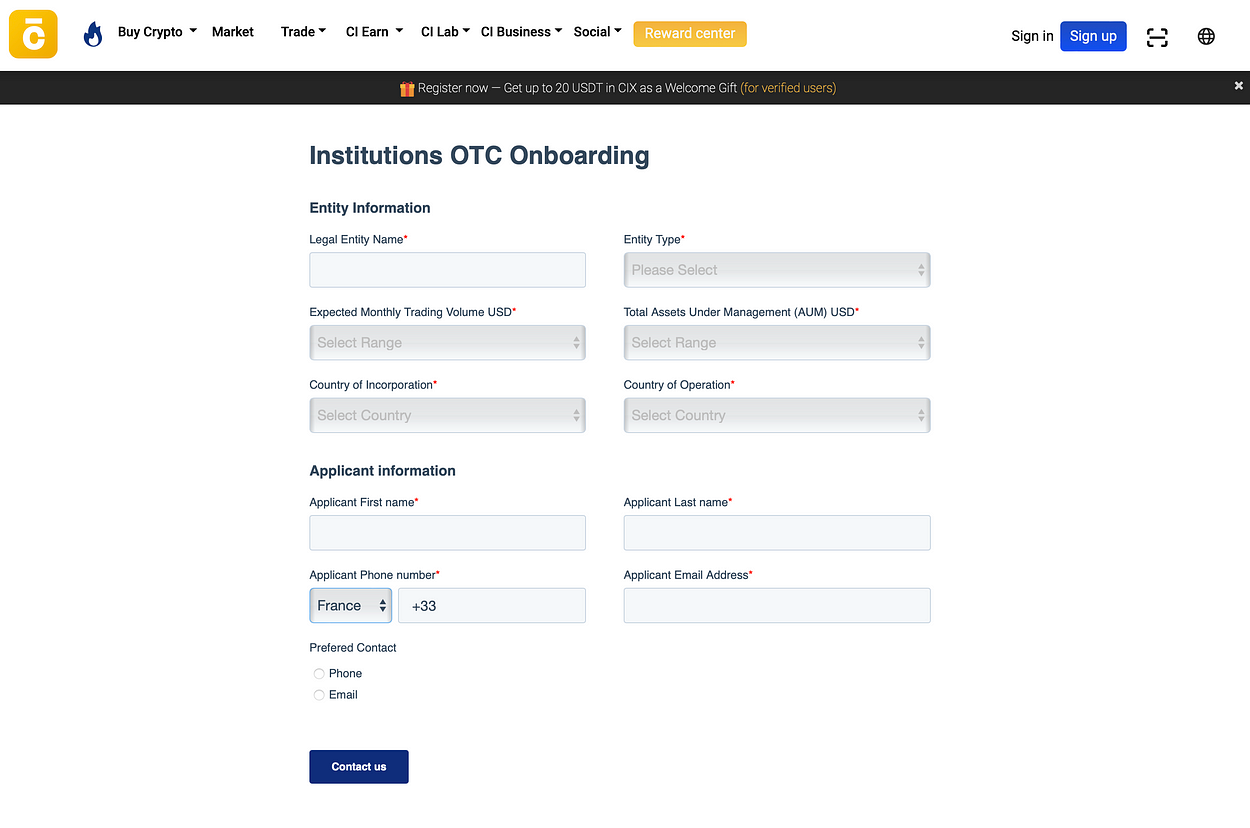

Form Submission:

The first step of the onboarding process requires the institution to fill out a form. This form serves as an initial contact point, providing essential information about the entity and applicant.

2. App Download and Account Creation:

In order to proceed further, the institution needs to download the CI-EX app from the appropriate app store. For Apple devices, the app is available here, while Android users can find it here. Upon installing the app, the institution will create an account on CI-EX.com, which will serve as the gateway for accessing the platform's services.

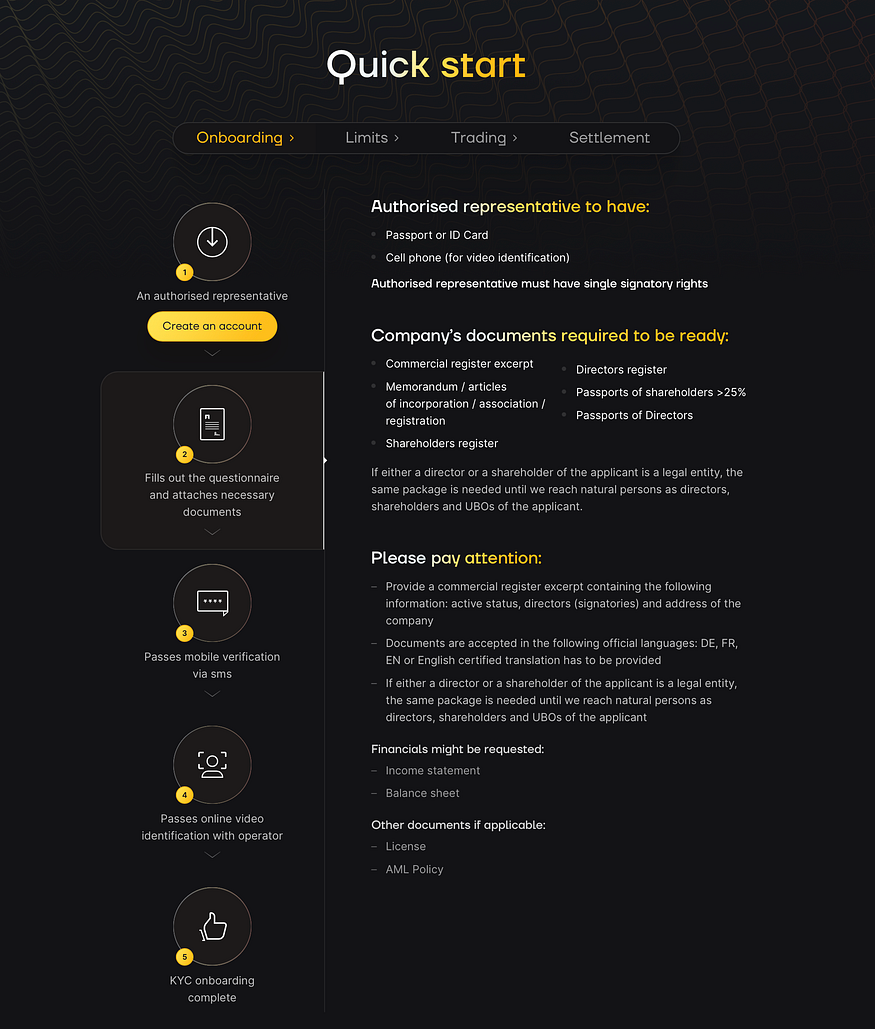

3. KYC and 2FA Completion:

CI-EX prioritizes security and compliance, requiring institutions to complete KYC process and set up Two-Factor Authentication (2FA).

The KYC process ensures the verification of the institution's identity, while 2FA provides an additional layer of protection against unauthorized access. Institutions can refer to this comprehensive step-by-step guide available on CI-EX.com to complete the KYC verification successfully.

4. KYB:

Once the institution has completed the KYC and 2FA process, they will receive a link via email to initiate the Know Your Business (KYB) procedure. The KYB process is carried out through Sumsub. Institutions will provide the necessary information and documentation to verify the legitimacy and compliance of their business operations.

5. Approval and Price Quoting:

After the successful completion of the KYB process, CI will review the institution's application and, upon approval, provide them with personalized price quotes for trading. This step marks the institution's readiness to engage in buying or selling activities on the CI platform.

6. Funds Transfer:

If the institution intends to buy cryptocurrencies, it will be required to wire USD or EUR to CI. On the other hand, if they plan to sell cryptocurrencies, they will need to send the respective digital assets to CI's designated wallet. These transfers will initiate the execution of the trading transactions.

7. Receipt of Cryptocurrency or Wire Transfer:

Upon receiving the necessary funds or cryptocurrency, CI will promptly fulfill its side of the transaction. If the institution purchased cryptocurrencies, CI will transfer the assets to their centurioninvest.com wallet. Alternatively, if the institution sold cryptocurrencies, CI will initiate a wire transfer of USD or EUR to the institution's designated account.

The Institutions OTC Onboarding Process offered by CI aims to simplify and expedite the onboarding journey for institutional clients. By following the outlined steps, institutions can establish a secure and compliant trading relationship with CI, unlocking a range of cryptocurrency trading opportunities. CI's commitment to security, transparency, and efficiency ensures a seamless experience for institutions looking to engage in the world of digital asset trading.

Click here to redirect you to the onboarding form .